The 4-Minute Quote: Re-engineering Global Logistics

Overview

Freight forwarding is a battle of margins. Operators traditionally lose hours manually comparing "Spot" prices (live market rates) against "Contract" prices (pre-negotiated rates). I led the design of Cacta’s core Rate Engine, transforming a fragmented 4-hour manual search into a 4-minute automated decision.

Impact

From Data Dumps to Quick Decisions

20% → 8% Lost Quotes

Created search engine which saved 15+ hours per week for every operator. 87% reduction in manual decision time.

4+ hrs→ 7min Quotes

Manual spreadsheet hell became instant AI spot rates. Reps handle 90% autonomously vs constant pricing pings.

87% AI Rate Acceptance

Reps ignored AI quotes without trust signals. Led confidence widgets + explainable UX across product/eng/data teams. Drove 87% acceptance vs 35% baseline.

Complexity → Clarity

Tokenized design system turned dense tables into scannable insights. By aligning design tokens with engineering variables, we halved the time it took to move from mocks to live production code.

The Problem

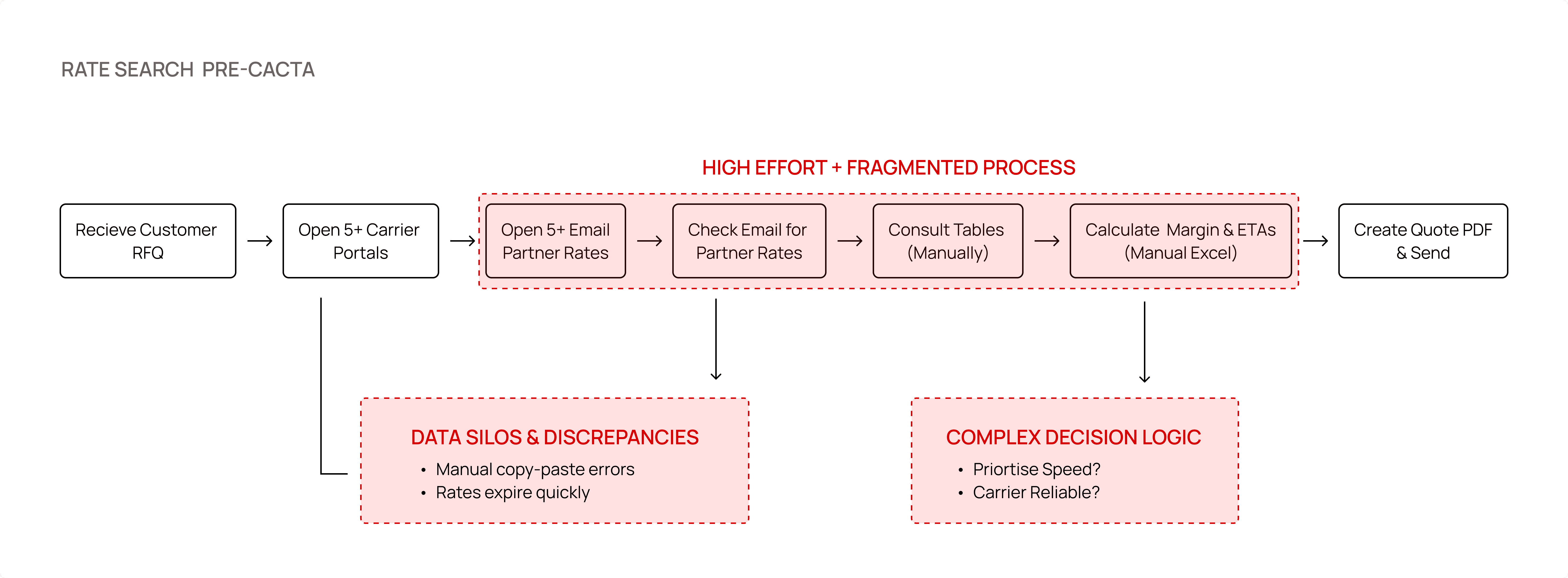

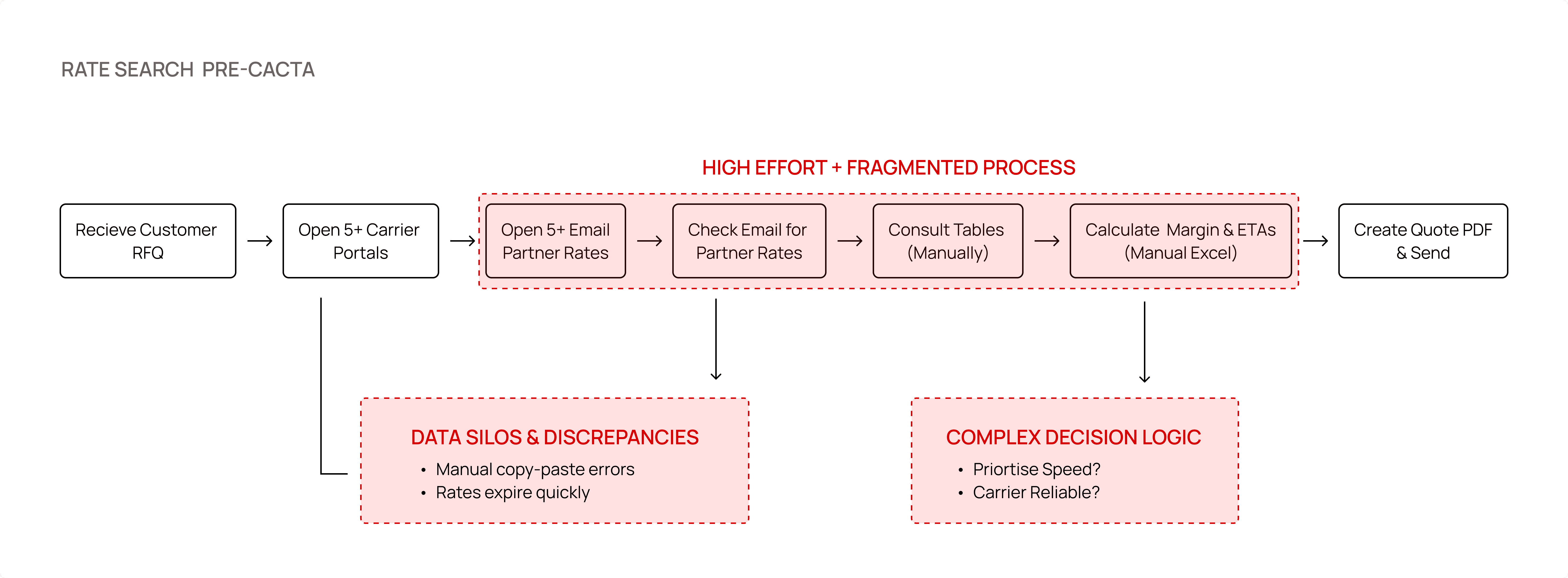

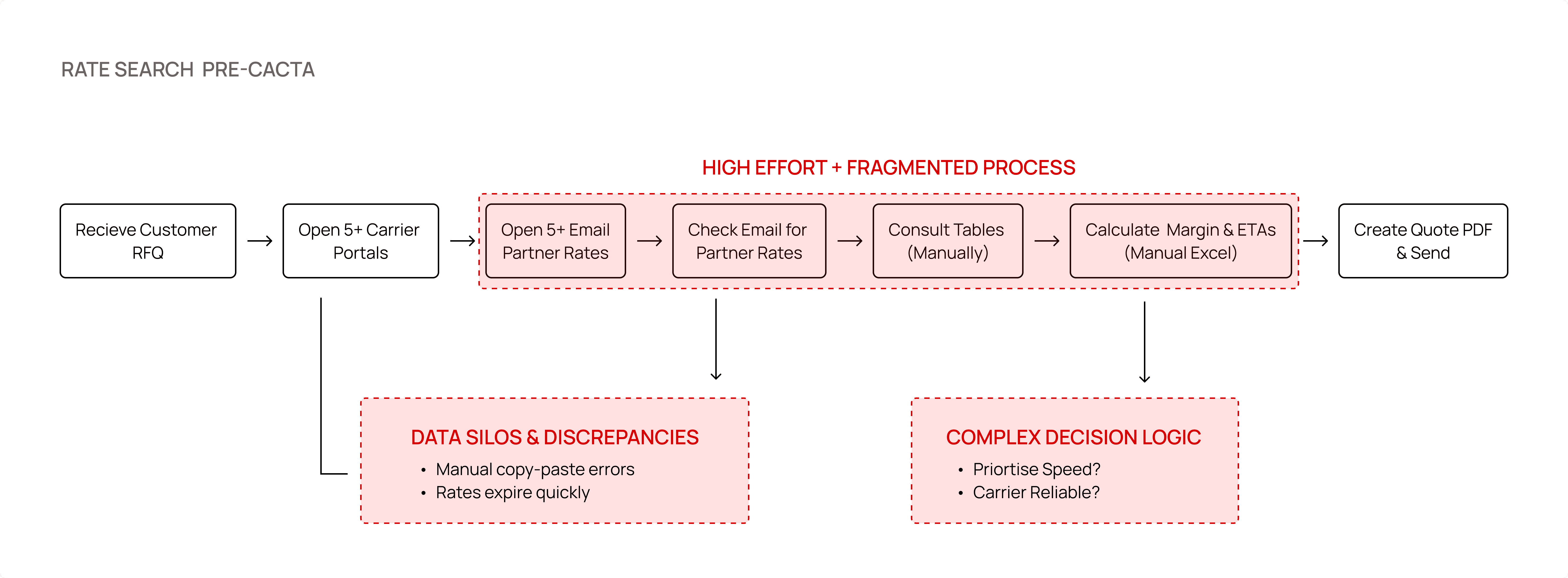

The Burden of Manual Interpretation

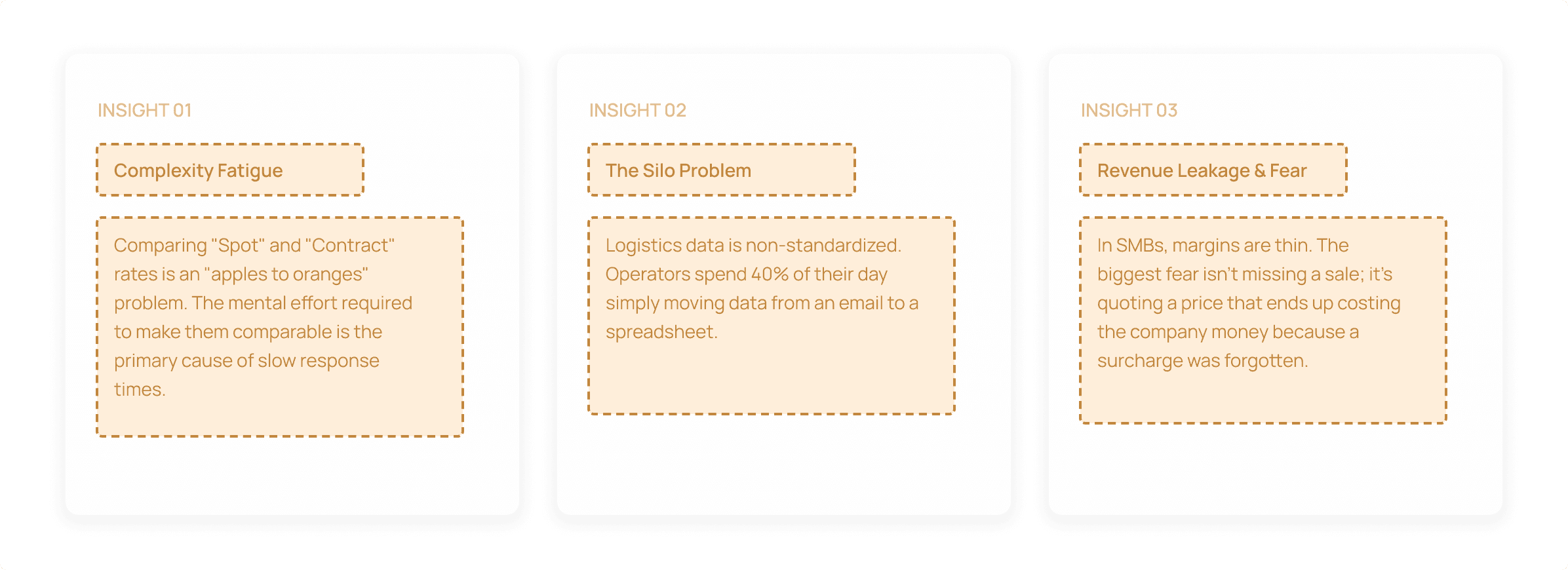

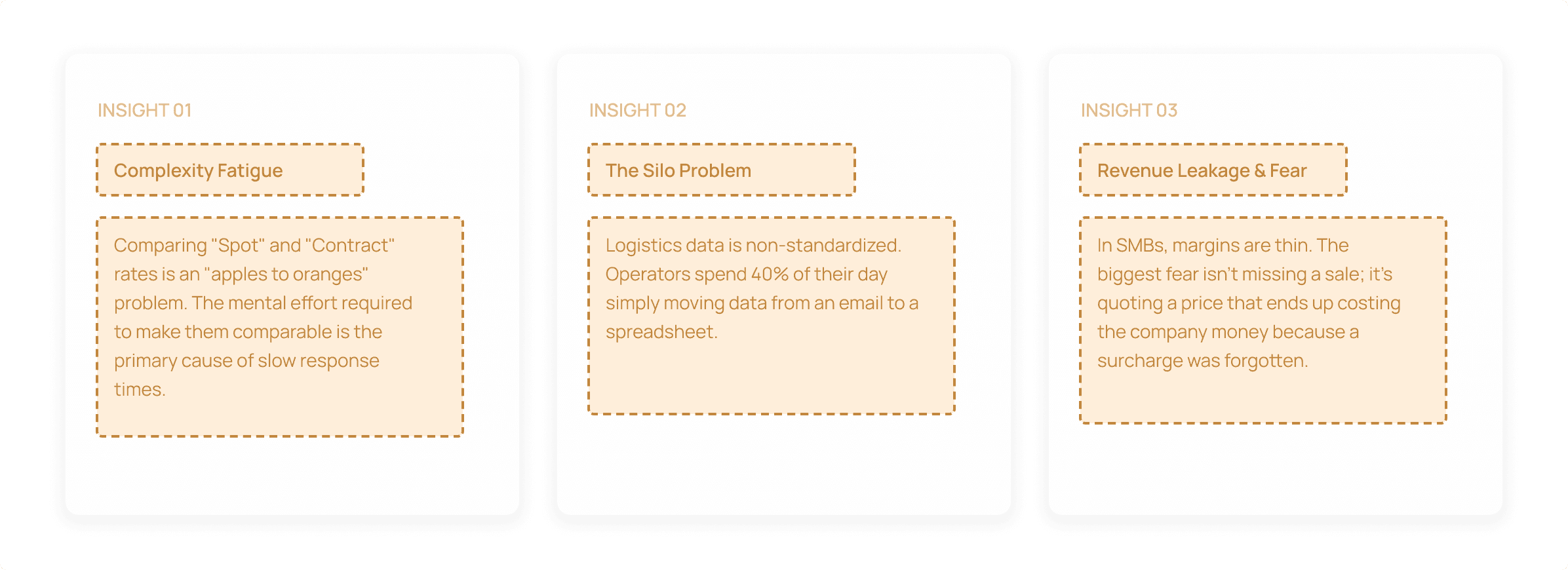

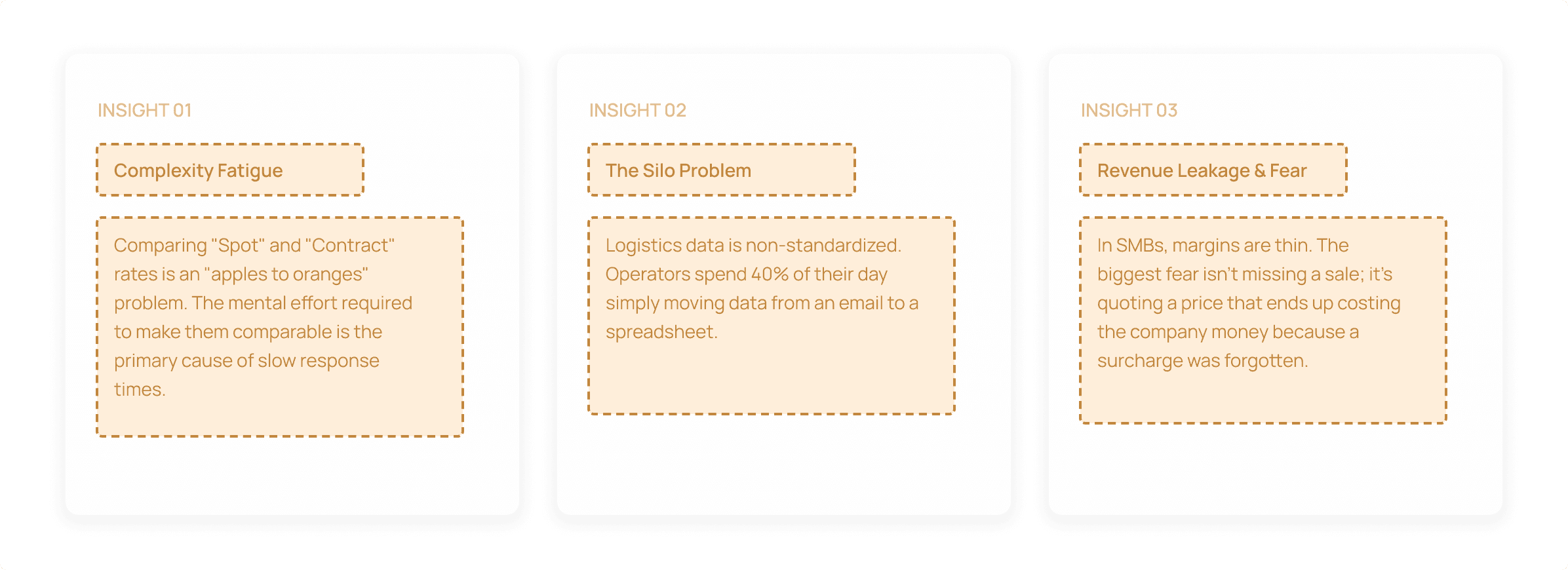

Freight forwarding is a battle of razor-thin margins. Through user interviews with SMB operators, I discovered that quoting wasn't just a data retrieval problem; it was an Interpretation Problem.

The Workflow Chaos: Operators spent 4+ hours per quote, toggling between 5+ carrier portals and endless email threads to find "Agent Rates" and "NAC Filings."

The Fragmented Core: Spot prices (live market) and Contract prices (pre-negotiated) lived in silos. Comparing them required manual Excel calculations for surcharges, leading to frequent "revenue leakage" from missed fees.

The Challenge

Bridging the "Black Box" Gap

The Goal: Transform a complex backend algorithm into a scannable, "Explainable AI" interface.

Cacta’s core USP is a backend AI algorithm that makes Spot and Contract rates comparable for the first time. However, the initial engine output was a "data dump" that users didn't trust because they couldn't see the math.

Defining the User

I identified the SMB Operator as our primary user because they act as the "Human API". This person manually bridges the gap between carrier data and customer quotes.

The Strategy

Making "Apples to Apples" Possible

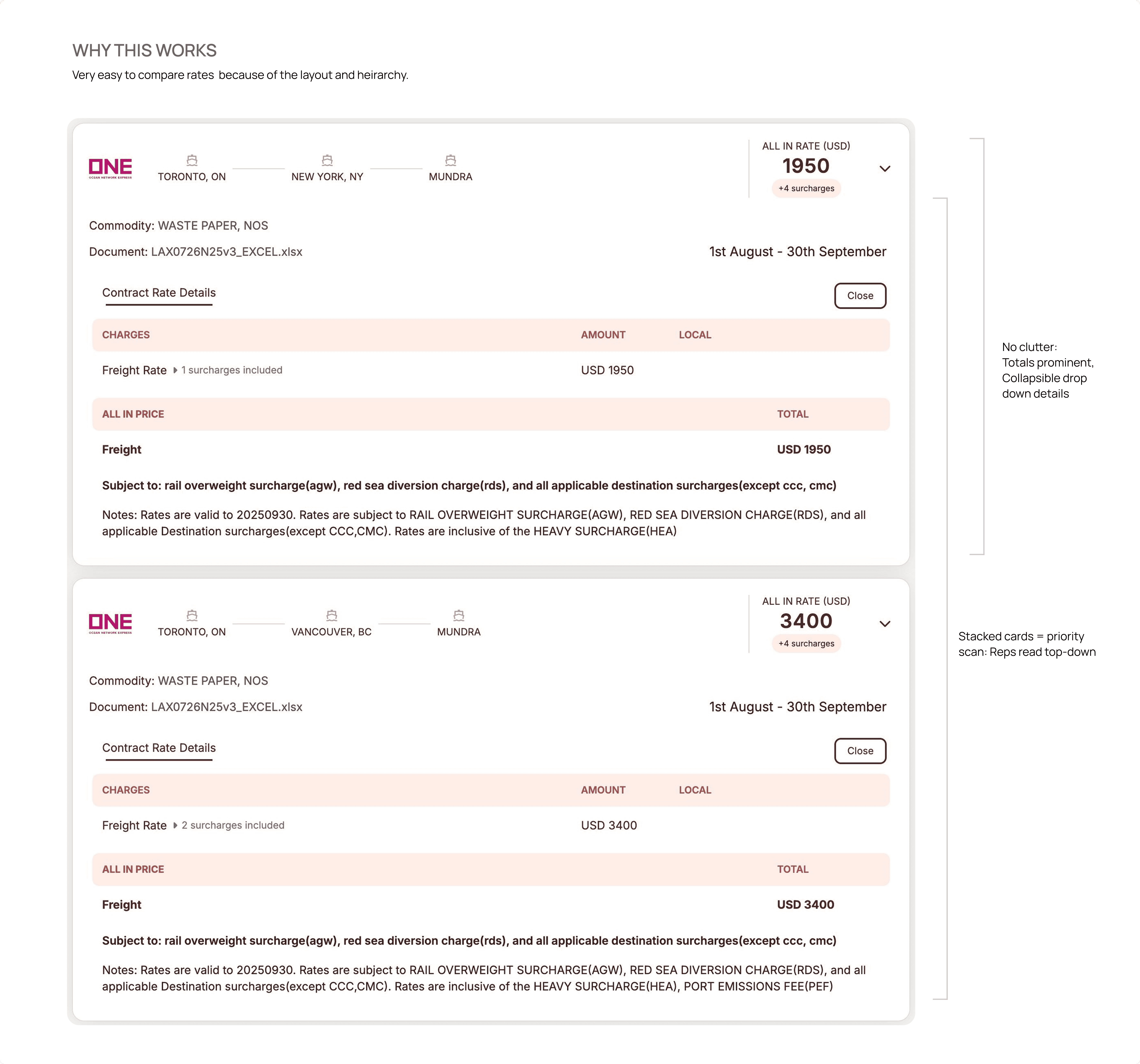

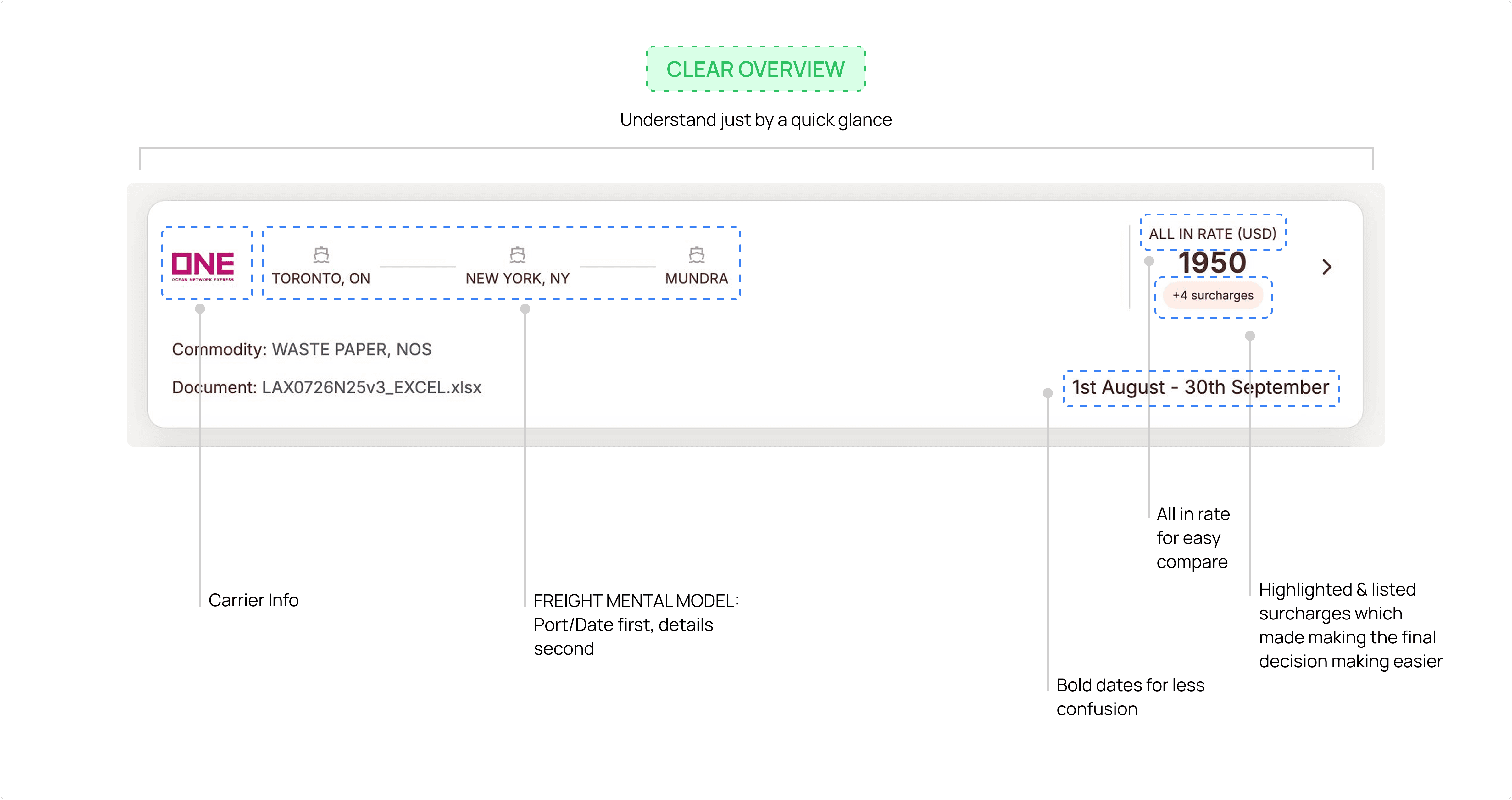

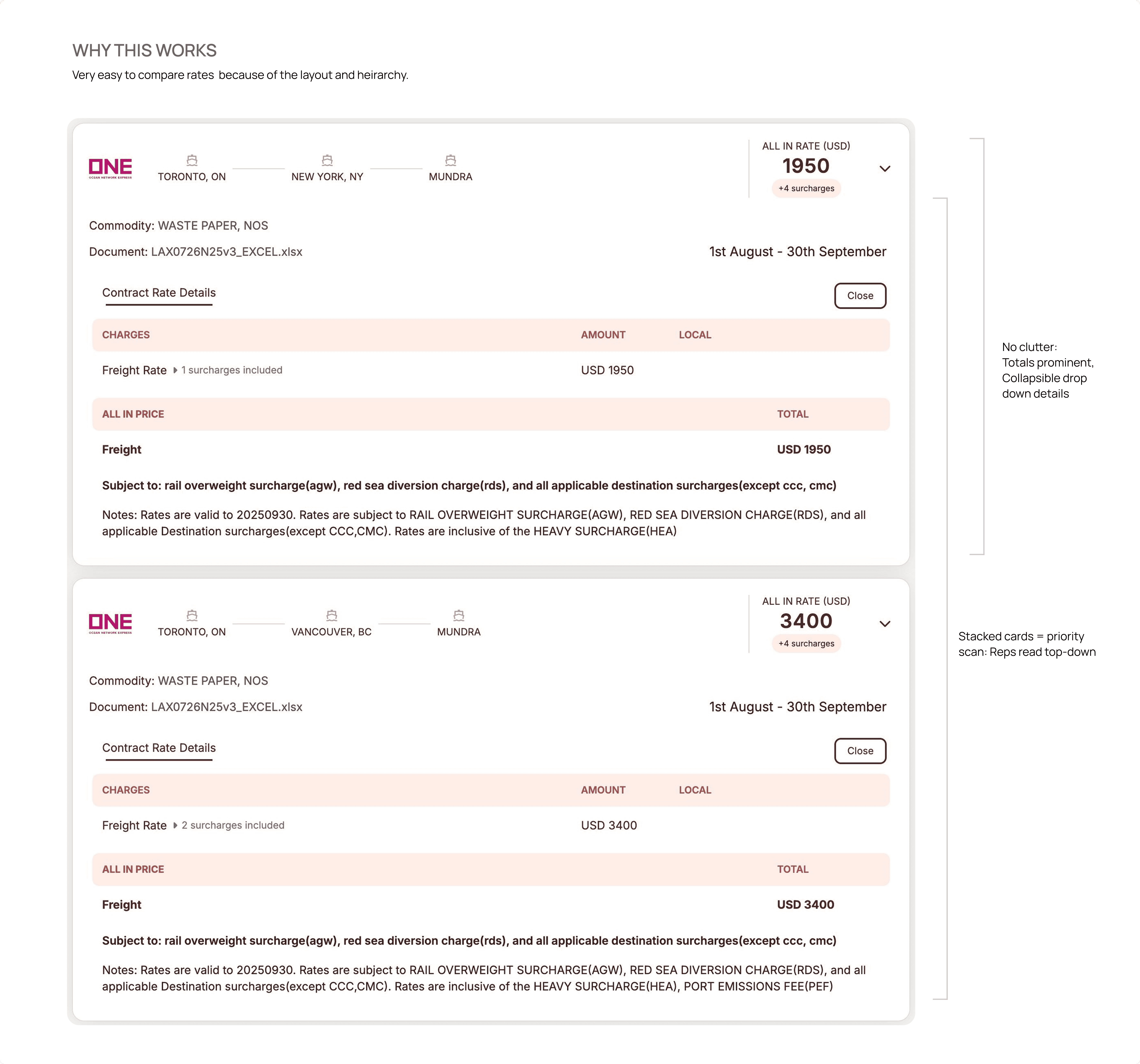

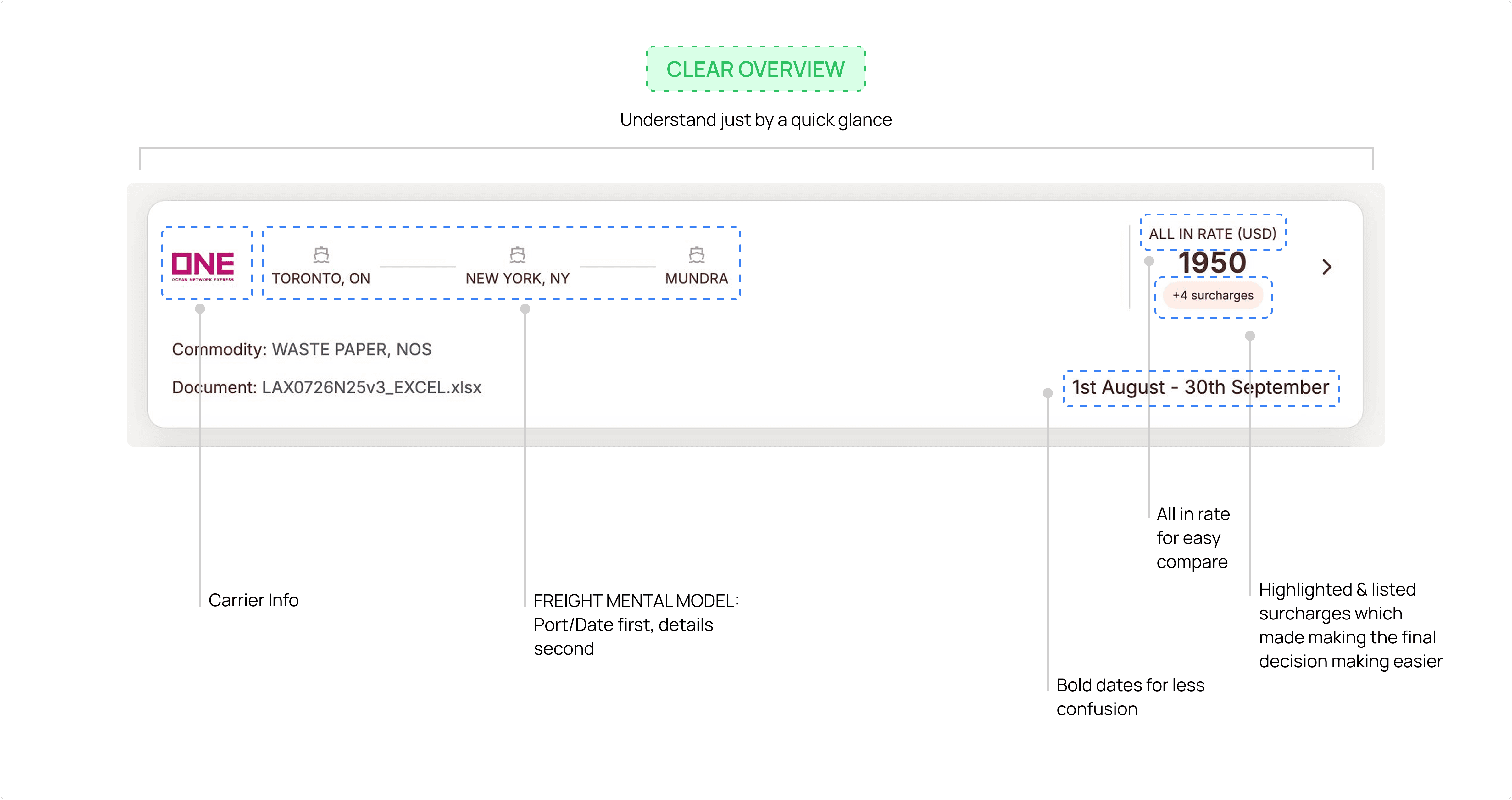

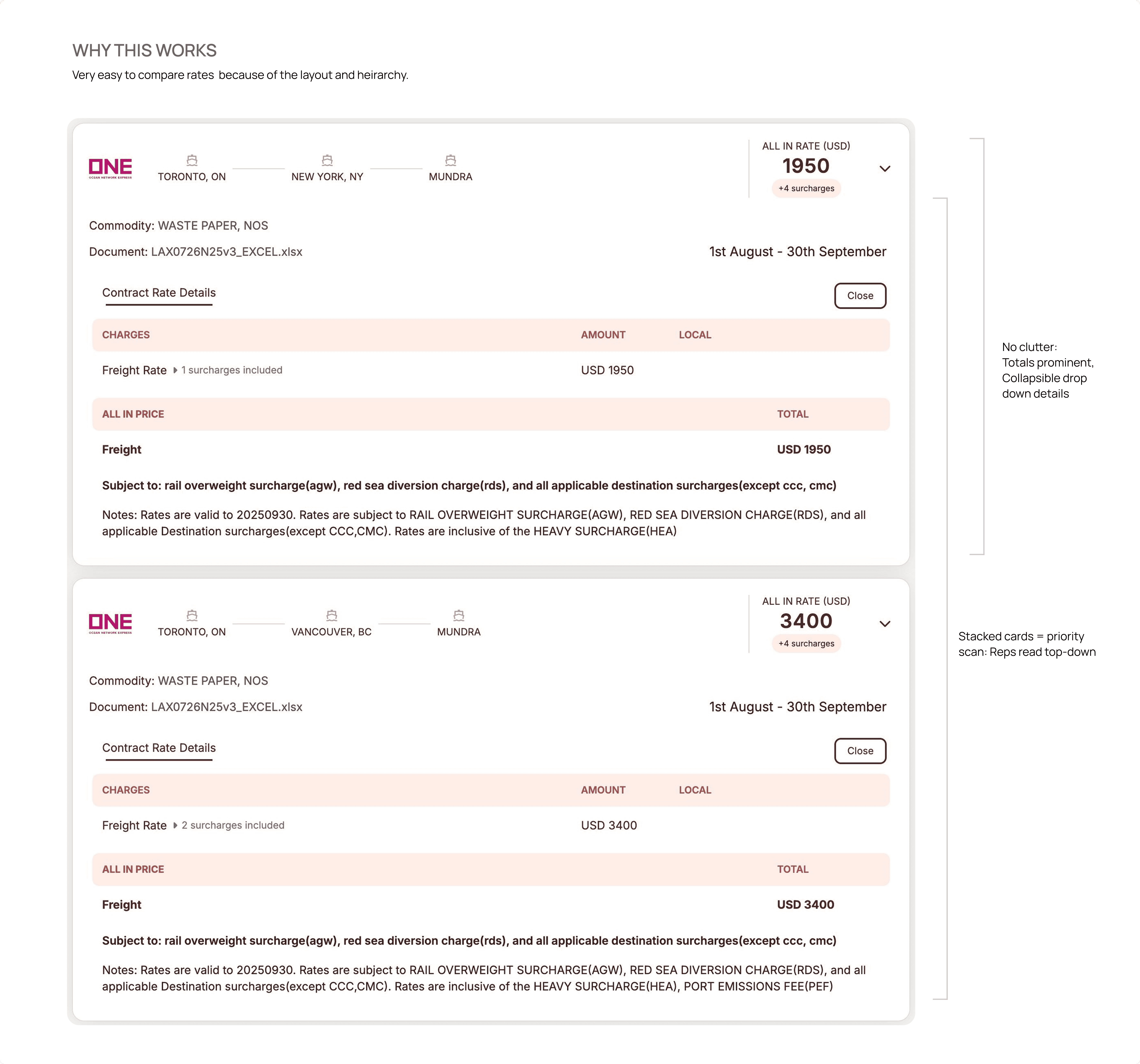

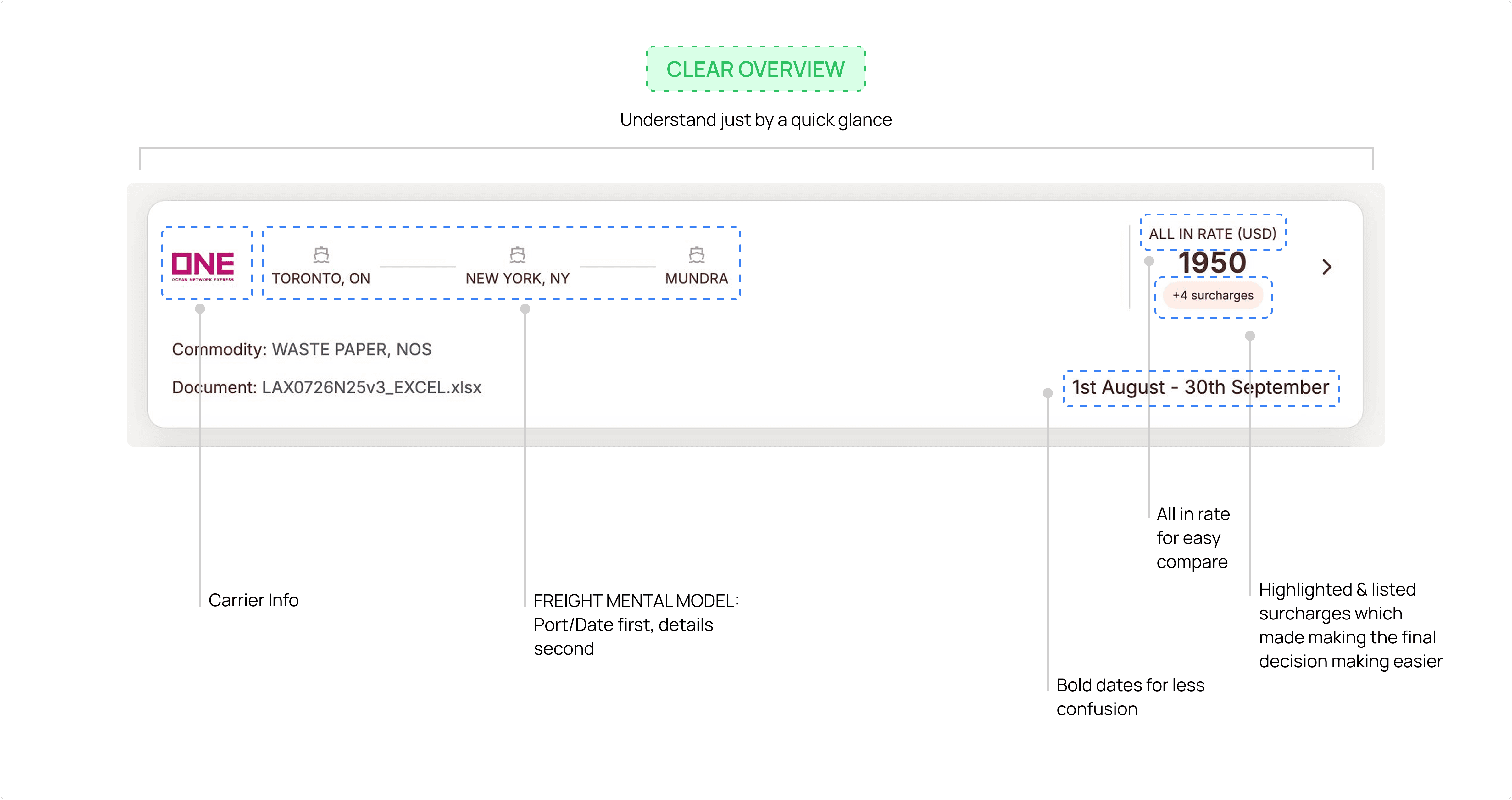

The heart of the project was the Spot vs. Contract Comparator. I moved away from vertical lists to a High-Density Comparative Grid.

Algorithmic Transparency:

I designed a logic-heavy sidebar that pulls line items like BAF (Bunker Adjustment Factor) and Peak Season Surcharges automatically.

Haulage-Inclusive Quotes:

I led the eng collab to integrate "Last Mile" trucking costs directly into the comparison, ensuring the AI's "Best Option" highlight accounted for the full journey.

Translating Complexity into Scannability

Working shoulder-to-shoulder with the Lead Engineer, I owned the creation of a Tokenized Pricing System.

Visual Cues:

We implemented color-coded paths to distinguish between Direct and Transshipment routes (e.g., Hapag-Lloyd VALIANT).

Best-Option Highlight:

A subtle but high-contrast "Optimal Path" badge was created to guide the user to the highest margin option identified by the AI.

Learnings & Reflections

Trust is a UI Component:

In AI-driven products, users don't need to see the code, but they need to see the evidence.

Systems Over Screens:

Mastering the haulage-inclusive logic required deep collaboration with devs to ensure our design tokens mapped perfectly to the backend's pricing variables.

90% Faster Turnaround

Quotes that took hours now take minutes.

3x Previous Volume

Allowing small teams to work more efficiently.

120h+ Saved/ Month

Reducing manual spreadsheet work.(Per User)

More Accurate Quotes

Reduced missed surcharges during final reconciliation

Overview

Freight forwarding is a battle of margins. Operators traditionally lose hours manually comparing "Spot" prices (live market rates) against "Contract" prices (pre-negotiated rates). I led the design of Cacta’s core Rate Engine, transforming a fragmented 4-hour manual search into a 4-minute automated decision.

Impact

From Data Dumps to Quick Decisions

20% → 8% Lost Quotes

Created search engine which saved 15+ hours per week for every operator. 87% reduction in manual decision time.

4+ hrs→ 7min Quotes

Manual spreadsheet hell became instant AI spot rates. Reps handle 90% autonomously vs constant pricing pings.

87% AI Rate Acceptance

Reps ignored AI quotes without trust signals. Led confidence widgets + explainable UX across product/eng/data teams. Drove 87% acceptance vs 35% baseline.

Complexity → Clarity

Tokenized design system turned dense tables into scannable insights. By aligning design tokens with engineering variables, we halved the time it took to move from mocks to live production code.

The Problem

The Burden of Manual Interpretation

Freight forwarding is a battle of razor-thin margins. Through user interviews with SMB operators, I discovered that quoting wasn't just a data retrieval problem; it was an Interpretation Problem.

The Workflow Chaos: Operators spent 4+ hours per quote, toggling between 5+ carrier portals and endless email threads to find "Agent Rates" and "NAC Filings."

The Fragmented Core: Spot prices (live market) and Contract prices (pre-negotiated) lived in silos. Comparing them required manual Excel calculations for surcharges, leading to frequent "revenue leakage" from missed fees.

The Challenge

Bridging the "Black Box" Gap

The Goal: Transform a complex backend algorithm into a scannable, "Explainable AI" interface.

Cacta’s core USP is a backend AI algorithm that makes Spot and Contract rates comparable for the first time. However, the initial engine output was a "data dump" that users didn't trust because they couldn't see the math.

Defining the User

I identified the SMB Operator as our primary user because they act as the "Human API". This person manually bridges the gap between carrier data and customer quotes.

The Strategy

Making "Apples to Apples" Possible

The heart of the project was the Spot vs. Contract Comparator. I moved away from vertical lists to a High-Density Comparative Grid.

Algorithmic Transparency:

I designed a logic-heavy sidebar that pulls line items like BAF (Bunker Adjustment Factor) and Peak Season Surcharges automatically.

Haulage-Inclusive Quotes:

I led the eng collab to integrate "Last Mile" trucking costs directly into the comparison, ensuring the AI's "Best Option" highlight accounted for the full journey.

Translating Complexity into Scannability

Working shoulder-to-shoulder with the Lead Engineer, I owned the creation of a Tokenized Pricing System.

Visual Cues:

We implemented color-coded paths to distinguish between Direct and Transshipment routes (e.g., Hapag-Lloyd VALIANT).

Best-Option Highlight:

A subtle but high-contrast "Optimal Path" badge was created to guide the user to the highest margin option identified by the AI.

Learnings & Reflections

Trust is a UI Component:

In AI-driven products, users don't need to see the code, but they need to see the evidence.

Systems Over Screens:

Mastering the haulage-inclusive logic required deep collaboration with devs to ensure our design tokens mapped perfectly to the backend's pricing variables.

90% Faster Turnaround

Quotes that took hours now take minutes.

3x Previous Volume

Allowing small teams to work more efficiently.

120h+ Saved/ Month

Reducing manual spreadsheet work.(Per User)

More Accurate Quotes

Reduced missed surcharges during final reconciliation

Overview

Freight forwarding is a battle of margins. Operators traditionally lose hours manually comparing "Spot" prices (live market rates) against "Contract" prices (pre-negotiated rates). I led the design of Cacta’s core Rate Engine, transforming a fragmented 4-hour manual search into a 4-minute automated decision.

Impact

From Data Dumps to Quick Decisions

20% → 8% Lost Quotes

Created search engine which saved 15+ hours per week for every operator. 87% reduction in manual decision time.

4+ hrs→ 7min Quotes

Manual spreadsheet hell became instant AI spot rates. Reps handle 90% autonomously vs constant pricing pings.

87% AI Rate Acceptance

Reps ignored AI quotes without trust signals. Led confidence widgets + explainable UX across product/eng/data teams. Drove 87% acceptance vs 35% baseline.

Complexity → Clarity

Tokenized design system turned dense tables into scannable insights. By aligning design tokens with engineering variables, we halved the time it took to move from mocks to live production code.

The Problem

The Burden of Manual Interpretation

Freight forwarding is a battle of razor-thin margins. Through user interviews with SMB operators, I discovered that quoting wasn't just a data retrieval problem; it was an Interpretation Problem.

The Workflow Chaos: Operators spent 4+ hours per quote, toggling between 5+ carrier portals and endless email threads to find "Agent Rates" and "NAC Filings."

The Fragmented Core: Spot prices (live market) and Contract prices (pre-negotiated) lived in silos. Comparing them required manual Excel calculations for surcharges, leading to frequent "revenue leakage" from missed fees.

The Challenge

Bridging the "Black Box" Gap

The Goal: Transform a complex backend algorithm into a scannable, "Explainable AI" interface.

Cacta’s core USP is a backend AI algorithm that makes Spot and Contract rates comparable for the first time. However, the initial engine output was a "data dump" that users didn't trust because they couldn't see the math.

Defining the User

I identified the SMB Operator as our primary user because they act as the "Human API". This person manually bridges the gap between carrier data and customer quotes.

The Strategy

Making "Apples to Apples" Possible

The heart of the project was the Spot vs. Contract Comparator. I moved away from vertical lists to a High-Density Comparative Grid.

Algorithmic Transparency:

I designed a logic-heavy sidebar that pulls line items like BAF (Bunker Adjustment Factor) and Peak Season Surcharges automatically.

Haulage-Inclusive Quotes:

I led the eng collab to integrate "Last Mile" trucking costs directly into the comparison, ensuring the AI's "Best Option" highlight accounted for the full journey.

Translating Complexity into Scannability

Working shoulder-to-shoulder with the Lead Engineer, I owned the creation of a Tokenized Pricing System.

Visual Cues:

We implemented color-coded paths to distinguish between Direct and Transshipment routes (e.g., Hapag-Lloyd VALIANT).

Best-Option Highlight:

A subtle but high-contrast "Optimal Path" badge was created to guide the user to the highest margin option identified by the AI.

Learnings & Reflections

Trust is a UI Component:

In AI-driven products, users don't need to see the code, but they need to see the evidence.

Systems Over Screens:

Mastering the haulage-inclusive logic required deep collaboration with devs to ensure our design tokens mapped perfectly to the backend's pricing variables.

90% Faster Turnaround

Quotes that took hours now take minutes.

3x Previous Volume

Allowing small teams to work more efficiently.

120h+ Saved/ Month

Reducing manual spreadsheet work.(Per User)

More Accurate Quotes

Reduced missed surcharges during final reconciliation