From Gut Feeling to 85% Data‑Led: How Muzify’s Alfred Rewired Artist Portfolios

Muzify sits on a goldmine of fan data: 10.4M+ quizzes played, listening history, and behavioral streaks from 3M+ users. However, this data was locked in the backend.

By clustering 3.4M fans into clear tiers and city‑level cohorts, Alfred helped teams focus on the top 4.2K superfans and the 23% who loved multiple artists, while a simple cohort builder cut targeting workflows from 3 hours to 8 minutes, improving both speed and precision.

The Problem

Muzify sits on a goldmine of fan data: 10.4M+ quizzes played, listening history, and behavioral streaks from 3M+ users. However, this data was locked in the backend.

Artist managers, touring planners, and label teams were making multi-million dollar decisions (tour routing, merch drops) using aggregate streaming numbers (e.g., "1M streams in India") rather than behavioral depth. They had no way to identify or target their true superfans.

The Solution

Alfred is a B2B Artist Intelligence Dashboard. It transforms Muzify’s raw fan signals into actionable cohorts, enabling teams to visualize superfan density by city, track multi-artist loyalty, and export high-intent audiences for campaigns.

My Role

I led the end-to-end design, managing two junior designers. I owned the stakeholder research, the information architecture, the component library, and the final handoff to engineering. We are a small team, so I look into QA as well.

Design Challenge

Translating 35+ data points into human insight.

Before sketching, I worked with the engineering team to categorize our raw signals into three actionable pillars for the dashboard:

Pillar 1: Identity & Loyalty

Pillar 2: Cultural Context

Pillar 3: Behavioral Engagement

• Account: Pro status, Apple Music sync

• Geo: City, Region, Country

• Loyalty: Single-Artist vs. Multi-Artist (Exclusive vs. Shared fandom)

• Quiz Data: Top Score, Leaderboard Rank

• Streaming: Listening Minutes, Top Genre

• Affinity: Artist overlaps, Listening depth

• Volume: Quizzes/week, Lifetime Plays

• Frequency: Current Streak (Days), Recency

• Gamification: Badges, Clash Wins/Losses

Research & Discovery

Methodology: Stakeholder Interviews (14 Participants)

I interviewed 7 Artist Managers, 4 Label Marketers, and 3 Touring Directors to validate the problem.

Key Insights:

The Routing Gap: "I don't care about countries. I need City-Level density to book venues." (100% of Touring Managers).

The Recency Bias: "A fan who streamed 100 times last year is useless. I need fans active this week for a presale."

The Collaboration Void: "We guess collaborations. We need to see which artists share our superfans."

Data Validation Pilot:

We analyzed 4 pilot artists (totaling 847K fans) and found:

• 42% of superfans were concentrated in just 15 cities (often missed by generic venue data).

• 23% were Multi-Artist Superfans (a massive untapped revenue stream for co-tours).

Solutions & Design Decisions

From Concept to "Alfred 1.0"

Decision 1: The "Tier Ladder"

Constraint: Stakeholders were overwhelmed by raw numbers.

Instead of a generic "Total Users" count, I designed a Tier Ladder as the dashboard's anchor. It segments fans based on a weighted algorithm (Badges + Quiz Volume + Listening Mins).

• Casual: 0-2 Badges (52K)

• Engaged: 3-7 Badges (11K)

• Superfan: 8+ Badges (4.2K)

• Top 1%: Leaderboard Elites (847)

Impact: Managers could answer "How big is my core?" in 3 seconds.

Decision 2: City Intelligence (The Dual View)

Constraint: Engineers pushed back on city-level granularity due to data load.

I argued for this feature based on the research insight that "Country data is useless for touring." We compromised on a Dual View architecture:

• Left: A heatmap for global density scanning.

• Right: A sortable table ranking cities by "Superfan Density" (not just volume).

• Result: Touring teams used this to find "hidden gem" cities where superfan density was high even if total streams were low.

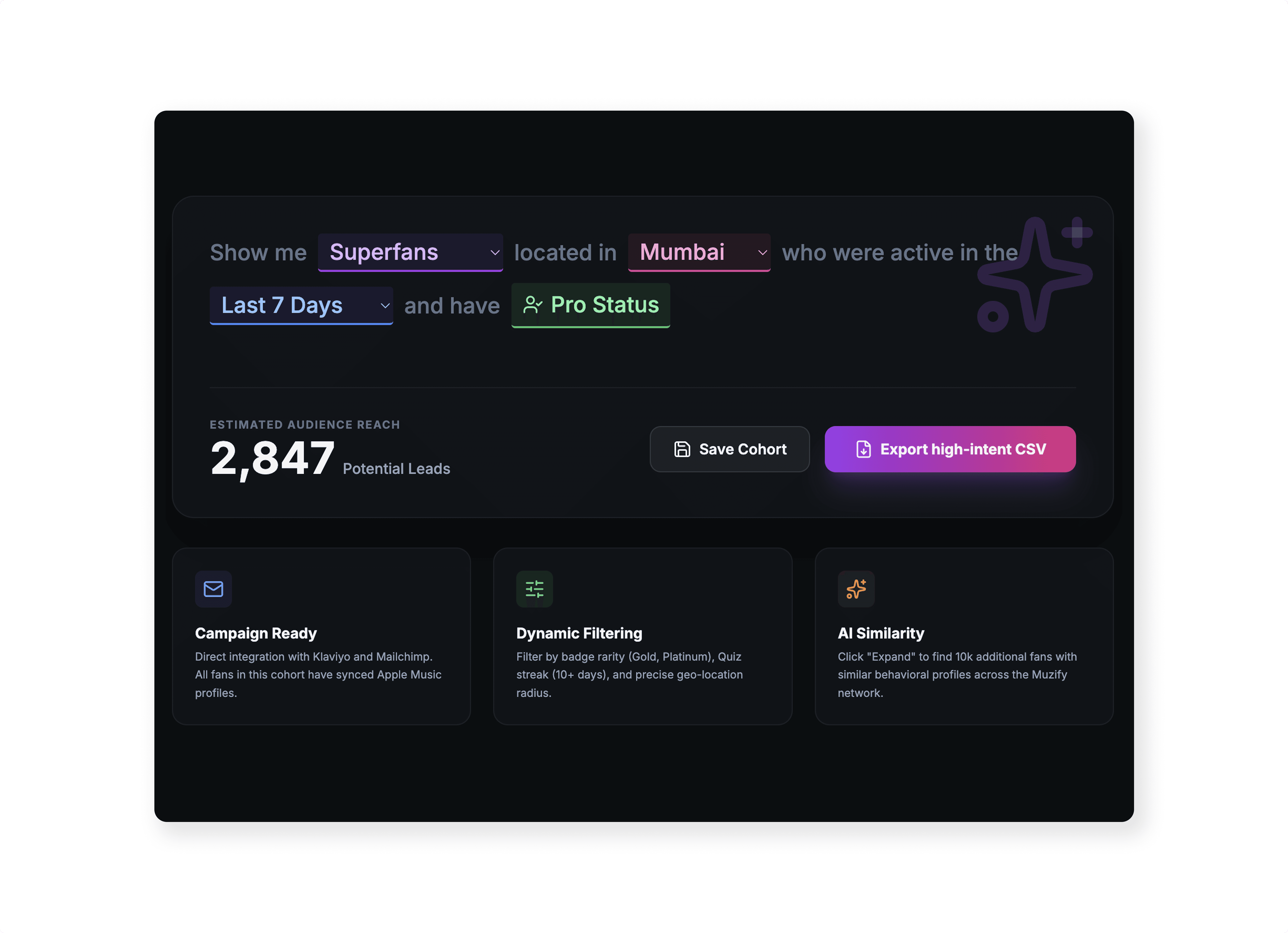

Decision 3: The Cohort Builder (Action Engine)

Goal: Close the gap between "Insight" and "Action."

I designed a query builder that uses natural language filtering:

• "Show me [Superfans] in [Mumbai] who are [Active Last 7 Days] and have [Pro Status]."

• Output: A downloadable CSV of 2,847 high-intent emails.

• Metric: Reduced campaign prep time from 3 hours to 8 minutes.

Decision 4: Multi-Artist Loyalty Toggle

Strategic Insight for A&R.

We created a toggle to switch the view between "Loyalists" (Exclusive to Artist A) and "Poly-Fans" (High affinity for Artist A + B + C).

• This allowed A&R teams to identify perfect collaboration partners based on shared audience data.

Outcomes & Business Impact

Post-Launch Metrics (12 Weeks)

Efficiency Wins:

• Campaign Prep: Time reduced by 96% (3 hours → 8 mins).

• Adoption: 83% of pilot teams integrated Alfred into their weekly workflow.

Revenue & Strategy Wins:

• €2.3M Opportunity: Identified 340K shared superfans between two artists, leading to a co-headlining tour proposal.

• Marketing ROI: Targeted "Active Superfan" cohorts lowered Customer Acquisition Cost (CAC) by 57% (€0.98 → €0.42).

• Venue Optimization: A "Hidden City" identified by Alfred (Bangalore) sold out a 2,000-cap venue that wasn't originally on the route.

Design System & Handoff

Leadership & Governance

As Lead, I ensured this wasn't just a "one-off" project. I delivered a scalable system:

• Component Library: 40+ reusable Figma components (TierLadder, CityTable, AffinityBubble).

• Spec Documentation: A guide detailing data mapping (e.g., "If badge_count > 8, render Superfan tag").

• Accessibility: Full WCAG AA compliance for data visualization colors.

Future Roadmap

• Predictive Analytics: "Mumbai superfans projected to grow 23% next month."

• Real-Time Data: Moving from nightly batching to hourly updates for live event tracking.

• Mobile Lite: A simplified view for managers on the road.

By clustering 3.4M fans into clear tiers and city‑level cohorts, Alfred helped teams focus on the top 4.2K superfans and the 23% who loved multiple artists, while a simple cohort builder cut targeting workflows from 3 hours to 8 minutes, improving both speed and precision.

The Problem

Muzify sits on a goldmine of fan data: 10.4M+ quizzes played, listening history, and behavioral streaks from 3M+ users. However, this data was locked in the backend.

Artist managers, touring planners, and label teams were making multi-million dollar decisions (tour routing, merch drops) using aggregate streaming numbers (e.g., "1M streams in India") rather than behavioral depth. They had no way to identify or target their true superfans.

The Solution

Alfred is a B2B Artist Intelligence Dashboard. It transforms Muzify’s raw fan signals into actionable cohorts, enabling teams to visualize superfan density by city, track multi-artist loyalty, and export high-intent audiences for campaigns.

My Role

I led the end-to-end design, managing two junior designers. I owned the stakeholder research, the information architecture, the component library, and the final handoff to engineering. We are a small team, so I look into QA as well.

Design Challenge

Translating 35+ data points into human insight.

Before sketching, I worked with the engineering team to categorize our raw signals into three actionable pillars for the dashboard:

Pillar 1: Identity & Loyalty

Pillar 2: Cultural Context

Pillar 3: Behavioral Engagement

• Account: Pro status, Apple Music sync

• Geo: City, Region, Country

• Loyalty: Single-Artist vs. Multi-Artist (Exclusive vs. Shared fandom)

• Quiz Data: Top Score, Leaderboard Rank

• Streaming: Listening Minutes, Top Genre

• Affinity: Artist overlaps, Listening depth

• Volume: Quizzes/week, Lifetime Plays

• Frequency: Current Streak (Days), Recency

• Gamification: Badges, Clash Wins/Losses

Research & Discovery

Methodology: Stakeholder Interviews (14 Participants)

I interviewed 7 Artist Managers, 4 Label Marketers, and 3 Touring Directors to validate the problem.

Key Insights:

The Routing Gap: "I don't care about countries. I need City-Level density to book venues." (100% of Touring Managers).

The Recency Bias: "A fan who streamed 100 times last year is useless. I need fans active this week for a presale."

The Collaboration Void: "We guess collaborations. We need to see which artists share our superfans."

Data Validation Pilot:

We analyzed 4 pilot artists (totaling 847K fans) and found:

• 42% of superfans were concentrated in just 15 cities (often missed by generic venue data).

• 23% were Multi-Artist Superfans (a massive untapped revenue stream for co-tours).

Solutions & Design Decisions

From Concept to "Alfred 1.0"

Decision 1: The "Tier Ladder"

Constraint: Stakeholders were overwhelmed by raw numbers.

Instead of a generic "Total Users" count, I designed a Tier Ladder as the dashboard's anchor. It segments fans based on a weighted algorithm (Badges + Quiz Volume + Listening Mins).

• Casual: 0-2 Badges (52K)

• Engaged: 3-7 Badges (11K)

• Superfan: 8+ Badges (4.2K)

• Top 1%: Leaderboard Elites (847)

Impact: Managers could answer "How big is my core?" in 3 seconds.

Decision 2: City Intelligence (The Dual View)

Constraint: Engineers pushed back on city-level granularity due to data load.

I argued for this feature based on the research insight that "Country data is useless for touring." We compromised on a Dual View architecture:

• Left: A heatmap for global density scanning.

• Right: A sortable table ranking cities by "Superfan Density" (not just volume).

• Result: Touring teams used this to find "hidden gem" cities where superfan density was high even if total streams were low.

Decision 3: The Cohort Builder (Action Engine)

Goal: Close the gap between "Insight" and "Action."

I designed a query builder that uses natural language filtering:

• "Show me [Superfans] in [Mumbai] who are [Active Last 7 Days] and have [Pro Status]."

• Output: A downloadable CSV of 2,847 high-intent emails.

• Metric: Reduced campaign prep time from 3 hours to 8 minutes.

Decision 4: Multi-Artist Loyalty Toggle

Strategic Insight for A&R.

We created a toggle to switch the view between "Loyalists" (Exclusive to Artist A) and "Poly-Fans" (High affinity for Artist A + B + C).

• This allowed A&R teams to identify perfect collaboration partners based on shared audience data.

Outcomes & Business Impact

Post-Launch Metrics (12 Weeks)

Efficiency Wins:

• Campaign Prep: Time reduced by 96% (3 hours → 8 mins).

• Adoption: 83% of pilot teams integrated Alfred into their weekly workflow.

Revenue & Strategy Wins:

• €2.3M Opportunity: Identified 340K shared superfans between two artists, leading to a co-headlining tour proposal.

• Marketing ROI: Targeted "Active Superfan" cohorts lowered Customer Acquisition Cost (CAC) by 57% (€0.98 → €0.42).

• Venue Optimization: A "Hidden City" identified by Alfred (Bangalore) sold out a 2,000-cap venue that wasn't originally on the route.

Design System & Handoff

Leadership & Governance

As Lead, I ensured this wasn't just a "one-off" project. I delivered a scalable system:

• Component Library: 40+ reusable Figma components (TierLadder, CityTable, AffinityBubble).

• Spec Documentation: A guide detailing data mapping (e.g., "If badge_count > 8, render Superfan tag").

• Accessibility: Full WCAG AA compliance for data visualization colors.

Future Roadmap

• Predictive Analytics: "Mumbai superfans projected to grow 23% next month."

• Real-Time Data: Moving from nightly batching to hourly updates for live event tracking.

• Mobile Lite: A simplified view for managers on the road.

By clustering 3.4M fans into clear tiers and city‑level cohorts, Alfred helped teams focus on the top 4.2K superfans and the 23% who loved multiple artists, while a simple cohort builder cut targeting workflows from 3 hours to 8 minutes, improving both speed and precision.

The Problem

Muzify sits on a goldmine of fan data: 10.4M+ quizzes played, listening history, and behavioral streaks from 3M+ users. However, this data was locked in the backend.

Artist managers, touring planners, and label teams were making multi-million dollar decisions (tour routing, merch drops) using aggregate streaming numbers (e.g., "1M streams in India") rather than behavioral depth. They had no way to identify or target their true superfans.

The Solution

Alfred is a B2B Artist Intelligence Dashboard. It transforms Muzify’s raw fan signals into actionable cohorts, enabling teams to visualize superfan density by city, track multi-artist loyalty, and export high-intent audiences for campaigns.

My Role

I led the end-to-end design, managing two junior designers. I owned the stakeholder research, the information architecture, the component library, and the final handoff to engineering. We are a small team, so I look into QA as well.

Design Challenge

Translating 35+ data points into human insight.

Before sketching, I worked with the engineering team to categorize our raw signals into three actionable pillars for the dashboard:

Pillar 1: Identity & Loyalty

Pillar 2: Cultural Context

Pillar 3: Behavioral Engagement

• Account: Pro status, Apple Music sync

• Geo: City, Region, Country

• Loyalty: Single-Artist vs. Multi-Artist (Exclusive vs. Shared fandom)

• Quiz Data: Top Score, Leaderboard Rank

• Streaming: Listening Minutes, Top Genre

• Affinity: Artist overlaps, Listening depth

• Volume: Quizzes/week, Lifetime Plays

• Frequency: Current Streak (Days), Recency

• Gamification: Badges, Clash Wins/Losses

Research & Discovery

Methodology: Stakeholder Interviews (14 Participants)

I interviewed 7 Artist Managers, 4 Label Marketers, and 3 Touring Directors to validate the problem.

Key Insights:

The Routing Gap: "I don't care about countries. I need City-Level density to book venues." (100% of Touring Managers).

The Recency Bias: "A fan who streamed 100 times last year is useless. I need fans active this week for a presale."

The Collaboration Void: "We guess collaborations. We need to see which artists share our superfans."

Data Validation Pilot:

We analyzed 4 pilot artists (totaling 847K fans) and found:

• 42% of superfans were concentrated in just 15 cities (often missed by generic venue data).

• 23% were Multi-Artist Superfans (a massive untapped revenue stream for co-tours).

Solutions & Design Decisions

From Concept to "Alfred 1.0"

Decision 1: The "Tier Ladder"

Constraint: Stakeholders were overwhelmed by raw numbers.

Instead of a generic "Total Users" count, I designed a Tier Ladder as the dashboard's anchor. It segments fans based on a weighted algorithm (Badges + Quiz Volume + Listening Mins).

• Casual: 0-2 Badges (52K)

• Engaged: 3-7 Badges (11K)

• Superfan: 8+ Badges (4.2K)

• Top 1%: Leaderboard Elites (847)

Impact: Managers could answer "How big is my core?" in 3 seconds.

Decision 2: City Intelligence (The Dual View)

Constraint: Engineers pushed back on city-level granularity due to data load.

I argued for this feature based on the research insight that "Country data is useless for touring." We compromised on a Dual View architecture:

• Left: A heatmap for global density scanning.

• Right: A sortable table ranking cities by "Superfan Density" (not just volume).

• Result: Touring teams used this to find "hidden gem" cities where superfan density was high even if total streams were low.

Decision 3: The Cohort Builder (Action Engine)

Goal: Close the gap between "Insight" and "Action."

I designed a query builder that uses natural language filtering:

• "Show me [Superfans] in [Mumbai] who are [Active Last 7 Days] and have [Pro Status]."

• Output: A downloadable CSV of 2,847 high-intent emails.

• Metric: Reduced campaign prep time from 3 hours to 8 minutes.

Decision 4: Multi-Artist Loyalty Toggle

Strategic Insight for A&R.

We created a toggle to switch the view between "Loyalists" (Exclusive to Artist A) and "Poly-Fans" (High affinity for Artist A + B + C).

• This allowed A&R teams to identify perfect collaboration partners based on shared audience data.

Outcomes & Business Impact

Post-Launch Metrics (12 Weeks)

Efficiency Wins:

• Campaign Prep: Time reduced by 96% (3 hours → 8 mins).

• Adoption: 83% of pilot teams integrated Alfred into their weekly workflow.

Revenue & Strategy Wins:

• €2.3M Opportunity: Identified 340K shared superfans between two artists, leading to a co-headlining tour proposal.

• Marketing ROI: Targeted "Active Superfan" cohorts lowered Customer Acquisition Cost (CAC) by 57% (€0.98 → €0.42).

• Venue Optimization: A "Hidden City" identified by Alfred (Bangalore) sold out a 2,000-cap venue that wasn't originally on the route.

Design System & Handoff

Leadership & Governance

As Lead, I ensured this wasn't just a "one-off" project. I delivered a scalable system:

• Component Library: 40+ reusable Figma components (TierLadder, CityTable, AffinityBubble).

• Spec Documentation: A guide detailing data mapping (e.g., "If badge_count > 8, render Superfan tag").

• Accessibility: Full WCAG AA compliance for data visualization colors.

Future Roadmap

• Predictive Analytics: "Mumbai superfans projected to grow 23% next month."

• Real-Time Data: Moving from nightly batching to hourly updates for live event tracking.

• Mobile Lite: A simplified view for managers on the road.